CEBA-Canada Emergency Business Account

The Canada Emergency Business Account (CEBA) was made available by the Government of Canada and Export Development Canada (EDC) to support businesses and non-profits adversely affected by COVID-19. Through the program, eligible businesses and non-profits were provided financial support (through the form of a loan) to cover short term operating expenses, payroll, and other non-deferrable expenses to help sustain business continuity.

The Government of Canada has stopped accepting applications for the CEBA loans as of July 1, 2021, but we are continuing to provide support to members with funded and outstanding CEBA loans.

For further information or support with your CEBA loan, please <insert directions on accessing webpage information and link or a help/support line/contact information>

IMPORTANT INFORMATION:

Updated February 2022

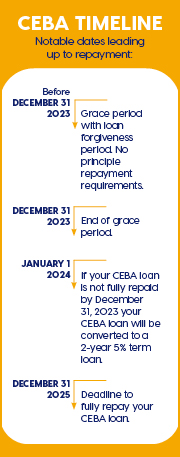

The Government of Canada recently announced the loan forgiveness qualification and the interest free period have both be extended to December 31, 2023 for loans in good standing.

Members with funded and outstanding CEBA loans please note the following important information on repayment terms:

Repayment terms if made by December 31, 2023:

- 0% interest will apply before January 1, 2024.

- Loan forgiveness will apply if the CEBA loan balance is less the eligible forgiveness amount. For example:

-

- If you are the recipient of a $40,000 loan: $10,000 will be forgiven if $30,000 of the loan balance is fully repaid by December 31, 2023.

- If you are the recipient of a $60,000 loan: $20,000 will be forgiven if $40,000 of the loan balance is fully repaid by December 31, 2023.

- If your CEBA loan is less than $40,000: 25% will be forgiven if 75% of the loan balance is fully repaid by December 31, 2023.

-

Repayment terms after January 1, 2024:

- A rate of 5% interest per annum will accrue on the balance of the loan.

- Full repayment (including principal and interest) is due and payable on December 31, 2025.

More general information about the program as well as frequently asked questions are available on Government of Canada CEBA page.here

If you have further questions, please connect with our Commercial Account Manager , Lorie Ann Richard at 506-622-9318 or email lrichard@beaubear.ca.

For more information on our other business products and services click here.